Cryptocurrency for Parents: What It Is, How Kids See It, and How to Keep Them Safe

A parent-friendly guide to understanding crypto, spotting scams, and protecting your family

- Cryptocurrency is digital money managed by computer networks, not banks or governments.

- Kids encounter crypto through influencers, games, and peer pressure—often without understanding the risks.

- Prices swing wildly. Scams are rampant. Young people can’t always handle the emotional rollercoaster.

- Open conversations matter far more than technical knowledge.

- If your teen does experiment, it should be with “learning money”—amounts they can afford to lose completely.

Why Parents Are Suddenly Hearing About Crypto

Cryptocurrency headlines have moved out of the financial pages and into your child’s social feeds, gaming chats, and school conversations. Terms like “Bitcoin,” “crypto wallet,” and “blockchain” pop up before you’ve had a chance to understand them yourself.

The real concern is that young people are actively being targeted. Influencers promise quick riches. Apps make trading feel like a game. Friends share “secret methods” that supposedly make money overnight. Meanwhile, actual scams disguise themselves as legitimate opportunities.

So let’s break this down—not to scare you, but so you actually understand what’s happening.

What Actually Is Cryptocurrency?

The Simple Version

Cryptocurrency is digital money managed by computer networks instead of banks or governments. Instead of a bank holding your account, a system called a “blockchain” keeps a record of who owns what.

Think of it like this: Normal money (pounds, dollars) is printed by governments and managed by banks. Crypto is created by computers and managed by a network of computers worldwide. No single authority controls it.

Key Differences from Real Money

- No bank: Your bank account is insured by the government. If the bank loses your money, you’re protected. Crypto has no insurance.

- No reversal: If you send money to the wrong person, banks can stop it. With crypto, once it’s sent, it’s gone.

- Extreme price swings: The pound stays roughly stable. Bitcoin can jump 20–50% in a single day.

- Harder to use: You can’t easily spend Bitcoin at Tesco. Most shops don’t accept it.

How Blockchain Works (Without the Jargon)

Here’s the core idea:

- Someone initiates a transaction (“I’m sending 1 Bitcoin to you”).

- Network computers verify it’s legitimate (checking that the person actually has that Bitcoin).

- The transaction gets recorded in a “block” along with other transactions.

- That block is locked using complex math (called “cryptography”).

- The block gets linked to previous blocks, creating a “chain” of transactions that can’t be altered.

It’s clever technology. But it doesn’t change the fundamental risk: if you lose your password or send money to a scammer, you’re on your own.

The Different Types of Cryptocurrency (And Why There Are Thousands)

There are currently over 10,000 cryptocurrencies in existence. Most will fail or disappear. Here’s what parents should know about the main ones:

| Cryptocurrency | Market Cap (Dec 2025) | What It Does | Parent Takeaway |

|---|---|---|---|

| Bitcoin (BTC) | $1.85 trillion | The original. Intended as digital money; acts like an investment asset. | Most recognizable. Still high-risk. Often promoted to teens by influencers. |

| Ethereum (ETH) | $353.37 billion | Runs “smart contracts”—programs that execute automatically. Powers many apps and NFTs. | More complex technology. Often seen in gaming and metaverse projects. |

| Tether (USDT) | $135 billion | “Stablecoin”—designed to stay at £1 value. Used for trading. | Less volatile, but has centralization and trust issues. Can be used as a scam vehicle. |

| XRP / Ripple | $113.67 billion | Designed for fast international bank transfers. | Less hype than Bitcoin. Lower volatility. Still high-risk. |

| Binance Coin (BNB) | $118.45 billion | Utility token for Binance exchange. Powers Binance Smart Chain apps. | Tied to a centralized exchange. If Binance has problems, BNB crashes. |

| Solana (SOL) | $70.91 billion | Fast blockchain for apps and NFTs. Popular in gaming communities. | Trendy with younger users. Known for NFT hype and broken promises. |

| Dogecoin (DOGE) | $19.61 billion | Started as a joke. Now treated like a real investment by some. | Very volatile. Heavily pushed by influencers. High scam risk. |

| Cardano (ADA) | $13.68 billion | Academic blockchain project. Aims to be more efficient than Ethereum. | Less hype than others. Still speculative. |

Altcoins, Tokens & Shitcoins—What’s the Difference?

- Bitcoin and Ethereum: Original cryptocurrencies with their own blockchains.

- Altcoins: Any cryptocurrency that isn’t Bitcoin. Ethereum, Dogecoin, Ripple, etc.

- Tokens: Digital assets built on top of existing blockchains (like apps built on Ethereum). Often tied to specific projects.

- “Shitcoins”: Tokens with no real use, no development, and no future. Created to pump and dump. Most new crypto projects fall into this category.

How Kids Actually Encounter Cryptocurrency

1. Influencers and Social Media

TikTok videos, YouTube shorts, and Instagram stories show people claiming they turned £500 into £5,000. It’s fast-paced, exciting, and—crucially—it focuses entirely on wins.

The loser’s story never gets told. The people who lost money don’t post videos. All your child sees is the highlight reel, and it creates a false sense of “everyone is making money except me.”

2. Games and Virtual Worlds

Some games use in-game currencies that look and feel like crypto. Some platforms now promote NFTs (digital collectibles) that can be bought, traded, and sold on external marketplaces. To a young person, the line between “fun game currency” and “real-world investment” gets very blurry.

3. Friends and Peer Pressure

Teenagers pass around tips: “This coin is going to the moon.” “This app gives you free crypto.” “This influencer has a method that actually works.” When a classmate claims to have doubled their money, fear of missing out kicks in hard—even if the story is exaggerated or won’t last.

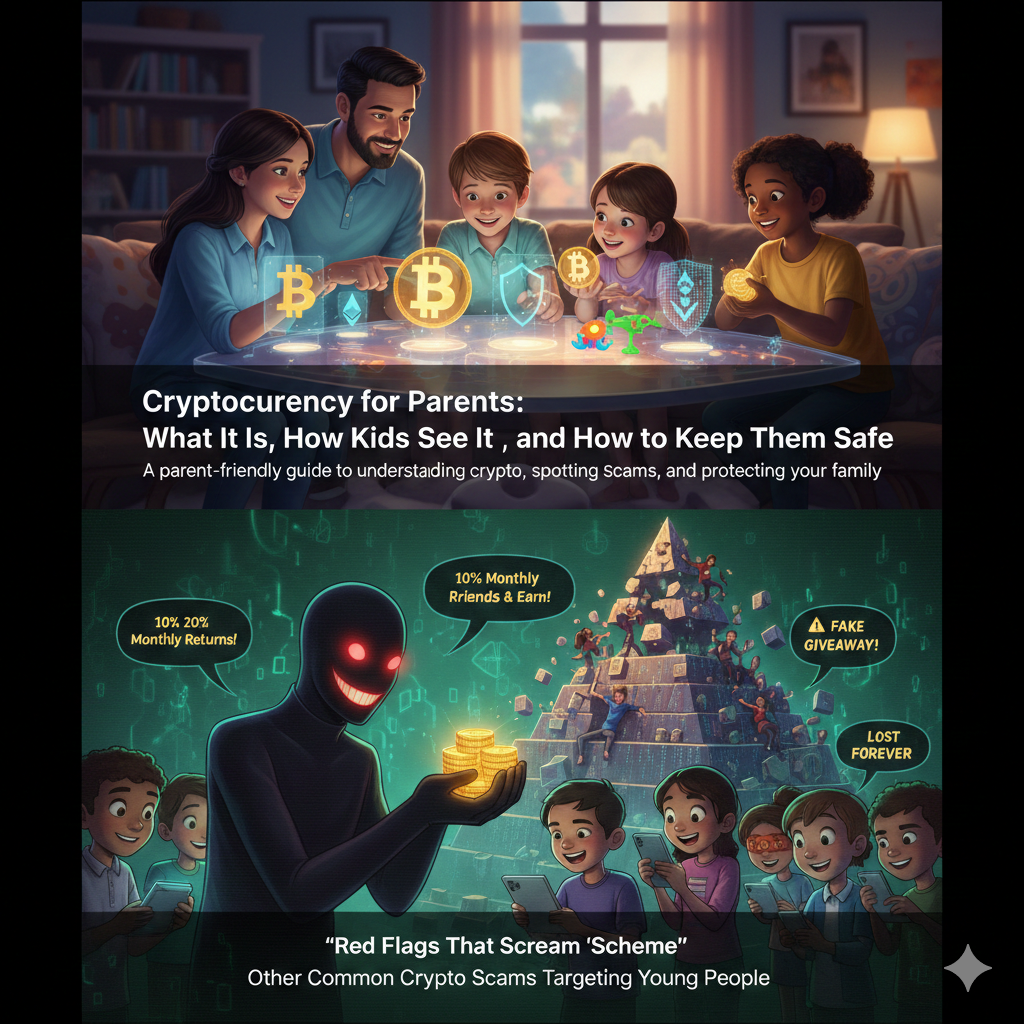

Pyramid Schemes and Ponzi Scams in Crypto

Before we talk about scams, let’s clarify what these are:

Ponzi Schemes

How it works: Early investors are paid “returns” using money from new investors. As long as new money keeps flowing in, it looks legitimate. The moment it slows, the whole thing collapses.

In crypto: A platform promises 10–30% monthly returns. It shows fake dashboards with increasing profits. Behind the scenes, there’s no actual investment—just a pool of stolen money.

Pyramid Schemes

How it works: You’re recruited to join. You pay to join. You’re then incentivized (sometimes heavily) to recruit others. Money flows from recruits at the bottom to people at the top.

In crypto: A “community” offers you a token and promises you’ll earn by recruiting friends. The only income comes from new recruits, not from any actual product or service.

Real Examples That Took Billions

OneCoin (2014–2017) — $4.4 Billion Lost

Marketed as a cryptocurrency by “Crypto Queen” Ruja Ignatova. The catch? OneCoin had no blockchain. It was a pyramid scheme selling fake educational packages and recruiting bonuses. Over 3 million people invested from 175 countries before it collapsed. Ruja disappeared and remains a fugitive.

PlusToken (2018–2019) — $2+ Billion Lost

A “wallet service” promising 10–30% monthly returns. Marketed heavily via WeChat to Chinese, South Korean, and Japanese investors. Operators disappeared with over 180,000 Bitcoin and 6 million Ethereum.

BitConnect (2016–2018) — $1+ Billion Lost

A platform promising daily returns via a fake “trading bot.” Users locked up Bitcoin and bought BitConnect Coin. Early investors were paid from new investor deposits. Regulatory action shut it down, but the damage was done.

Red Flags That Scream “Pyramid Scheme”

- Emphasis on recruitment: “Earn more by inviting friends.” “Build your downline.” “Referral bonuses.”

- Upfront payments to join: You have to pay to start. That’s money you might not get back.

- Guaranteed high returns: “10% monthly returns” or “Double your money in 30 days.” No legitimate investment guarantees this.

- Pressure to reinvest: “Lock up your earnings to get bigger returns next month.” Your money never actually reaches your hands.

- Unclear how money is made: If you can’t understand how the platform actually makes profit, it probably doesn’t.

- Celebrity or influencer promotion: Famous people suddenly promoting a new coin. Often they’re paid to do it without disclosing it.

- Urgency and FOMO: “The price will explode tomorrow!” “This offer expires in 24 hours!” Legitimate investments don’t need pressure tactics.

- Vague whitepapers: A whitepaper (technical document) that sounds impressive but explains nothing real.

Other Common Crypto Scams Targeting Young People

1. “Rug Pulls”

A new crypto project launches. Creators hype it heavily. Everyone buys in. Suddenly, the developers disappear with all the money. The project website goes offline.

2. Fake Giveaways

“Send 1 Bitcoin, get 2 back!” (Or 10 Ethereum, etc.) This never works. You send your crypto. They pocket it. You get nothing.

3. Romance Scams

Someone contacts your teen on social media or a dating app. They build trust over weeks. Then they suggest a “sure-thing” crypto investment or ask for money to help with an “emergency.” The person doesn’t exist.

4. Cloud Mining Scams

“Invest in our mining operation and earn passive income!” There’s often no actual mining. Your money gets pooled and slowly drained, or used to pay earlier “investors.”

5. Fake Websites and Apps

A lookalike exchange or wallet app. You deposit money. It gets stolen. The site vanishes.

The Real Risks for Young People

Extreme Price Swings and Emotional Damage

Crypto prices can move by 10–50% in a single day. For an inexperienced young person, that’s not investing—it’s a rollercoaster that encourages panic-selling when prices drop and gambling-like excitement when they rise.

Losing money early on can be genuinely traumatic for a teenager. It can damage their confidence around money for years.

Privacy and Data Risks

Opening accounts, joining exchanges, and using new apps all mean sharing personal data. Teenagers often reuse passwords, skip security steps, or share screenshots that expose sensitive information. These habits create long-term risks far beyond the immediate crypto activity.

Distorted Ideas About Work and Money

If your teenager mainly hears stories about overnight millionaires, education and steady work start looking pointless. They may chase high-risk opportunities constantly, believe luck matters more than effort, or undervalue savings and building actual skills.

Access Without Oversight

Most crypto platforms require you to be 18. If your teen is trading, they might be using an adult’s ID, a prepaid card, or unregulated overseas services. Each route has weaker protections.

Practical Safety Steps You Can Take Right Now

Control Payment Methods

Limit who can add cards or payment apps to devices. Use parental controls to require your approval for any purchase. On shared devices, enable strong authentication.

Turn Off In-App Purchases

Many trading apps are designed to feel like games. Disable in-app purchases where possible, or require a password for every transaction.

Encourage Security Habits

Unique passwords for every account. A password manager for older teens. Two-factor authentication on any financial account. Yes, it feels like overkill. It’s not.

Set Clear Family Boundaries

For example:

- “You don’t send money or invest online without checking with me first.”

- “You never share ID documents or bank details via messaging apps—not even if it looks like your friend asking.”

- “If someone online offers you quick money or a ‘secret method,’ that’s a scam. Tell me immediately.”

If Your Child Has Already Been Scammed

Focus first on understanding what happened and making sure they’re safe. Then you can address the financial side. Don’t shame them. Ask questions. Learn together.

- Get the details: Which platform? How much? What were they promised?

- Document everything: Screenshots, emails, transaction records.

- Report it: To the platform, the UK’s National Crime Agency, and Action Fraud (actionfraud.police.uk).

- Check their other accounts: Scammers often reuse compromised passwords. Make sure they change passwords on email and other services.

- Monitor their credit: Young people aren’t immune to identity theft. If personal details were shared, consider a credit check.

Should Your Teen Invest in Crypto?

The honest answer: Probably not.

But here’s what you might consider instead:

For Primary-Age Children

No buying or holding any cryptocurrency. They don’t have the judgment to handle it.

For Teenagers

If they’re genuinely interested in blockchain technology (not just making quick money), you might allow:

- Learning about crypto: Following news, analyzing price charts, researching how blockchains work.

- Paper trading: Simulating crypto trades without real money.

- Small “learning money” investments: An amount they can afford to lose completely, treated as education, not wealth-building. For example, £10–£50, not hundreds.

What You Should NOT Do

- Don’t let them borrow money to invest.

- Don’t let them use money meant for school, hobbies, or savings.

- Don’t set up an account in your name for them to access.

- Don’t frame it as an “investment opportunity” that will make them rich.

Frequently Asked Questions

A: Digital money managed by computer networks instead of banks, whose value swings wildly and which is often promoted to young people by influencers.

A: No. Cryptocurrency is designed for adults and carries high risks: extreme price swings, scams, data privacy issues, and emotional damage from losses. Young people usually lack the experience to handle these risks.

A: Look for guaranteed profits, pressure to act fast, requests to keep it secret, demands for money up front. If you see any of these, it’s a scam. Don’t send anything and talk to a trusted adult.

A: Stay calm. Don’t blame them. Ask what happened. Report it to the platform and Action Fraud (actionfraud.police.uk). Unfortunately, most stolen crypto cannot be recovered, but reporting helps authorities track scammers.

A: The underlying technology (blockchain) is genuinely innovative and has legitimate uses. But for most young people and families, the risks far outweigh any benefits. Focus on education, not investment.

The Bottom Line

Cryptocurrency is technology, yes. But it’s high-risk, highly speculative, and heavily promoted by people who profit when young people invest.

Your job as a parent isn’t to become a crypto expert. It’s to:

- Understand the basics (you’ve just done this).

- Know the red flags (pyramid schemes, scams, unrealistic promises).

- Have an open conversation with your teen about money, risk, and why some opportunities are too good to be true.

- Set clear boundaries and monitor their online financial activity.

- Model healthy skepticism: “This sounds like easy money. How does that actually work? Who profits?”

For most households, the safest path is to treat crypto as a topic to study and understand, not a product to buy.